Overview of the roles and responsibilities of fiduciaries as governed by the Employee Retirement Income Security Act of 1974 (ERISA)

Who is a “FIDUCIARY” for ERISA purposes?

ERISA fiduciaries are either named in the plan document or are identified by the function they perform for the plan. Since fiduciary status may be based on a person’s conduct rather than his title, it is possible to be a fiduciary without being aware of it.

Named Fiduciary

Typically, the plan sponsor (the employer) is specifically identified as the “named fiduciary” of the plan in the plan’s governing document, with principal responsibility for its oversight and management.

Functional Fiduciary

A fiduciary under ERISA also includes any person who:

- Exercises discretionary authority or control over the plan’s management;

- Exercises any authority over the management or disposition of the plan’s assets;

- Renders “investment advice” for any compensation with respect to plan funds; or

- Has discretionary authority or responsibility with respect to plan administration.

If a person acts or possesses fiduciary-like powers, the person will be deemed to be a functional fiduciary regardless of his title or official designation. Thus, if a person actually renders investment advice, as described above, for which he is compensated, he or she will be treated as a fiduciary.

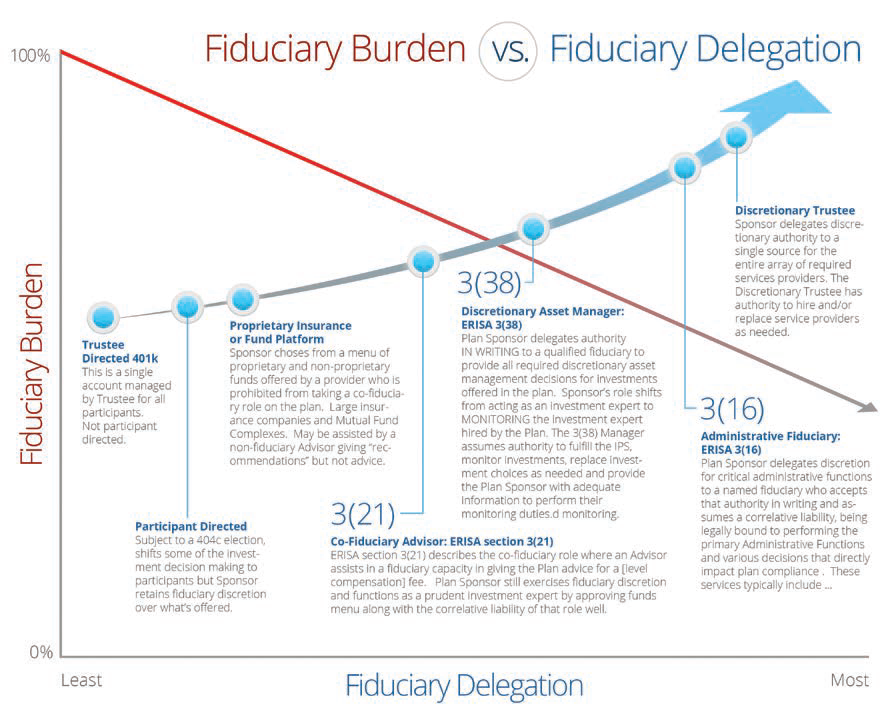

ERISA defines three types of functional fiduciaries:

1st 3(16) Fiduciaries

The term "3(16) Fiduciary" is a reference to Section 3(16) of ERISA, which describes a special kind of Plan fiduciary that is plainly referred to as the "Administrator" of a Plan. ERISA Section 3(16) provides that the Administrator is "the person specifically so designated by the terms of" the Plan's governing document. Every Plan must have a person which serves as its Administrator for ERISA purposes, and if no person is designated, the employer is automatically deemed to be the Administrator.

A "3(16) Fiduciary" or "Administrator" has particular reporting and disclosure responsibilities under ERISA.

This "Administrator" definition under ERISA should never be confused with administrative service providers. Thus, this statutory term should not be used to describe a TPA which does not accept any fiduciary responsibility from the Plan sponsor. Although a plan's 3(16) Fiduciary is technically a special kind of Named Fiduciary, it is often helpful to view the 3(16) Fiduciary as a separate and distinct type of fiduciary designated under the plan.

2nd 3(21) Fiduciaries

Many financial advisors make recommendations and provide other non-discretionary investment advice to their plan clients as 3(21) Fiduciaries. These advisors customarily acknowledge in writing that their advice will include "investment advice" for ERISA purposes, and they expect the plan sponsor and/or the plan's participants to rely on this advice as the primary basis for their investment decisions.

ERISA expressly authorizes the plan's Named Fiduciary to hire other fiduciaries to provide investment advice and to assist the plan sponsor discharge its investment duties under the plan. (As discussed, the Named Fiduciary is typically the plan sponsor but it could also be a third party 3(16) Fiduciary.) Under relevant case law, the courts have ruled that plan sponsors are permitted to rely on the advice they obtain from independent experts, including 3(21) Fiduciaries. However, the courts have ruled that the plan sponsor is prohibited from following an expert's advice blindly. Instead, the plan sponsor must (1) investigate the expert's qualifications, (2) provide the expert with complete and accurate information, and (3) make certain that reliance on the expert's advice is reasonably justified under the circumstances.

MVM does not provide tax, accounting or legal advice.

3rd 3(38) Fiduciaries

Rather than relying on the services of a 3(21) Fiduciary that provides non-discretionary advice, a plan sponsor may utilizes the services of a wholly different type of fiduciary advisor, a 3(38) Fiduciary.

3(38) Fiduciaries are historically associated with defined benefit pension plans. However, this type of fiduciary can also provide investment services to defined contribution plans, and they offer the greatest fiduciary protection available under ERISA. As discussed, a 3(38) Fiduciary by its nature must have discretionary investment authority. In the case of a defined contribution plan, this means that the 3(38) Fiduciary must have the authority to unilaterally add or remove investments from the plan's menu on behalf of the plan.

The fiduciary protection gained by plan sponsors who are willing to surrender this level of investment control over the plan's menu is meaningful. If the plan sponsor appoints a 3(38) Fiduciary, the plan sponsor will not be liable for the individual acts or omissions of the investment manager and will not have any direct oversight responsibility over the plan investments that are under the investment manager's control. Instead, the 3(38) Fiduciary alone is responsible for the prudence of its individual acts or omissions under ERISA.

Are Financial Advisors fiduciaries?

Plan sponsors often look to financial advisors to help them with their fiduciary investment responsibilities under ERISA. And these financial advisors can come in all shapes and sizes. They may be associated with broker-dealers, insurance companies, banks and trust companies as well as registered investment advisers. Many financial advisors associated with broker-dealers, insurance companies and banks provide non-fiduciary advice. However, MVM is a registered investment advisors who provides fiduciary advice.

Depending on our clients' needs MVM can act as a 3(21) and/or a 3(38) fiduciary.

More Information for:

Business Owners and Institutions

Back to Home