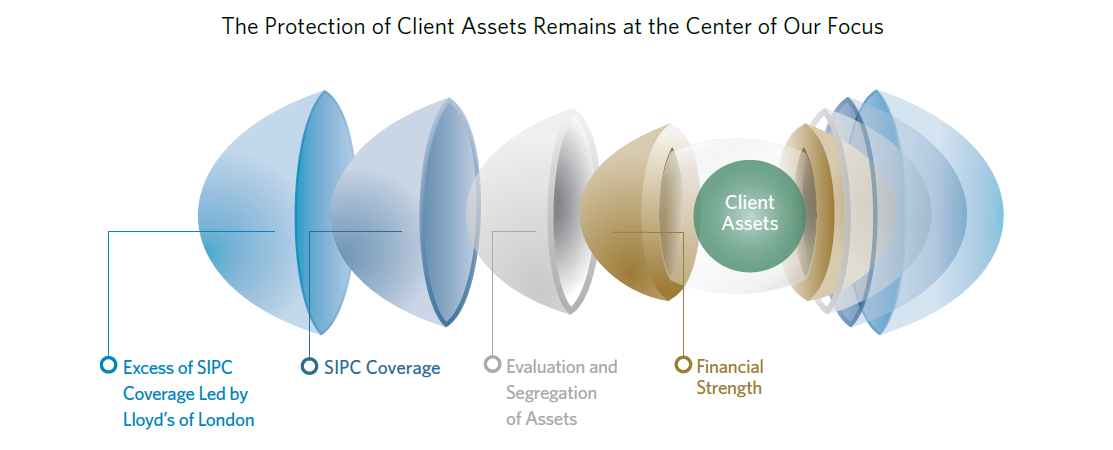

In general, all custodians that MVM works with are members of the Securities Investor Protection Corporation ("SIPC”) *. They protect customer accounts for a maximum coverage of $500,000 (with a cash sublimit of $250,000) and usually the custodian has an excess SIPC policy with a secondary insurance underwriter for up to an additional $30 million (with a cash sublimit of $900,000) subject to an aggregate limit of $150 million.

Futures and options on futures are not covered. As with all securities firms, this coverage provides protection against failure of a broker-dealer, not against loss of market value of securities.

For specifics details on account protection, please review the custodian's individual website or account documentation.

MVM Advisors works with most major custodians, providing our clients with the ability to custody their assets at the custodian, or any combination of custodians, they chose. Each individual custodian offers unique pricing structures, resources, and products. Because MVM is always looking for cutting edge technology and to reduce clients' expenses, most of our clients' assets are held with Interactive Brokers Group and/or Mid Atlantic Capital Corporation.

Interactive Brokers Group Strength and Security

Interactive Brokers Due Diligence Letter

Mid Atlantic Capital Group is a leading financial services organization

*SIPC is a non-profit, membership corporation funded by broker-dealers that are members of SIPC. For more information about SIPC and answers to frequently asked questions (such as how SIPC works, what is protected, how to file a claim, etc.), please refer to the following websites:

http://www.SIPC.org

http://www.finra.org/InvestorInformation/InvestorProtection/SIPCProtection/index.htm

More Information for: