MVM Advisors uses next generation financial and tax planning software along with years of real world experience to help you meet you financial goals!

MVM, feels that there are some basic aspects of financial life that everyone should have a good handle on. We make these powerful financial tools available for free because everyone deserves access to them. When things become more complex, MVM offers unbiased fee only fiduciary advice along with a full suite of comprehensive financial planning and wealth management services to help you achieve your goals.

Organize all your accounts in one place, track you net worth, understand where your money goes, reduce unwanted spending

Your information is secure

WE DO NOT SAVE YOUR CREDENTIALS

Below are some of the features in the RightCapital financial planning software.

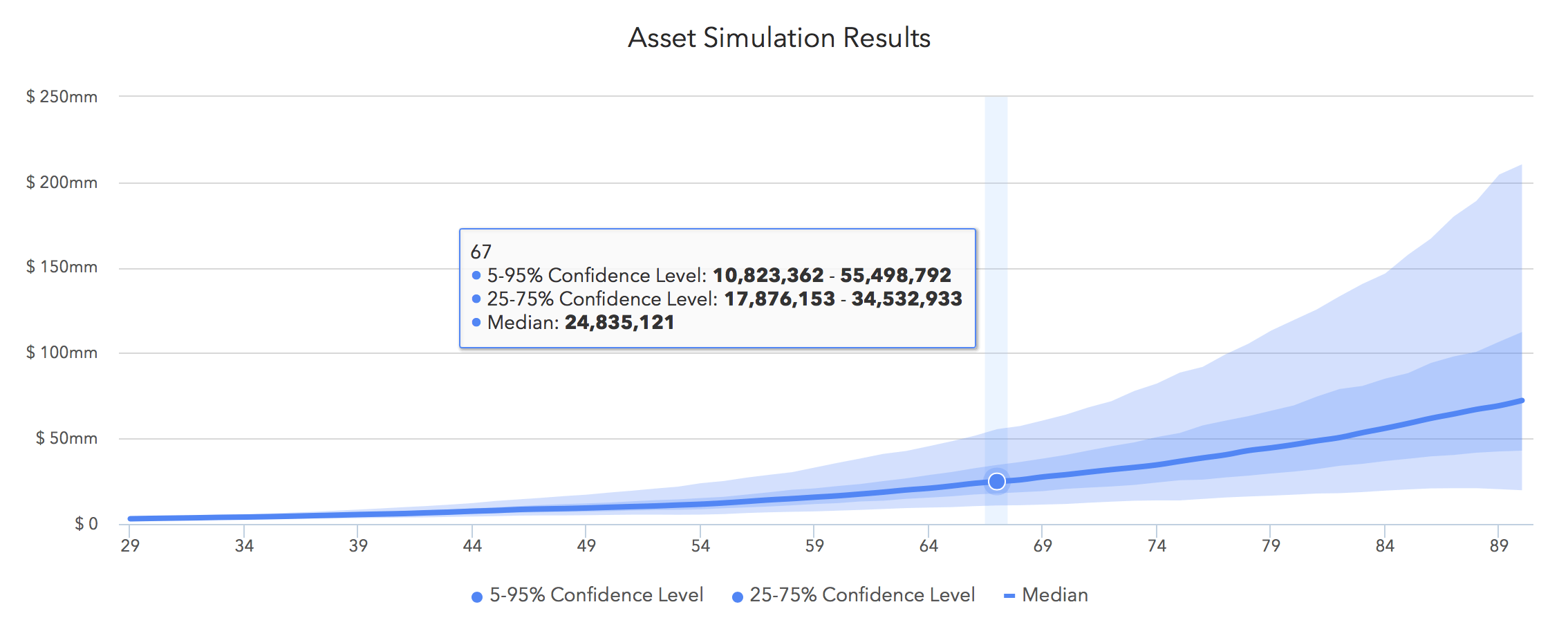

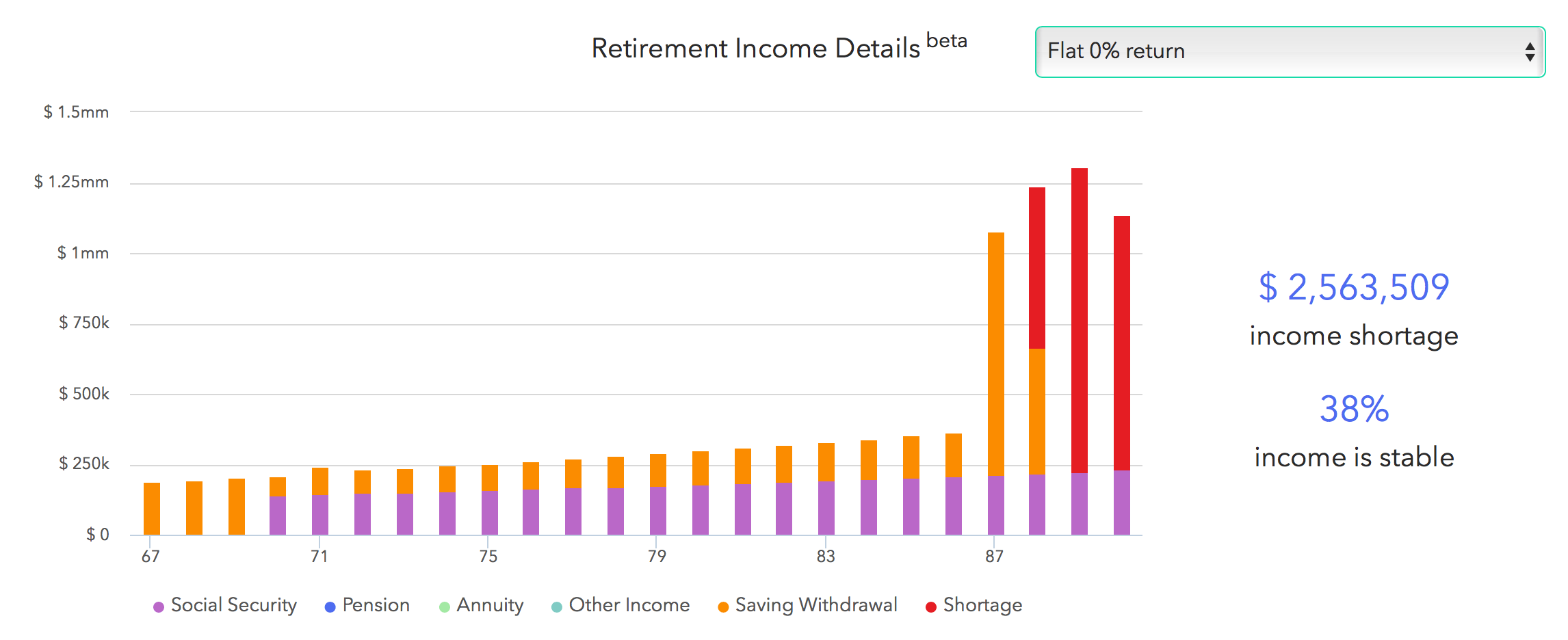

Advanced Monte Carlo simulations help MVM build robust retirement plans

Cash flow and goal based planning

Build in stress tests and what-ifs

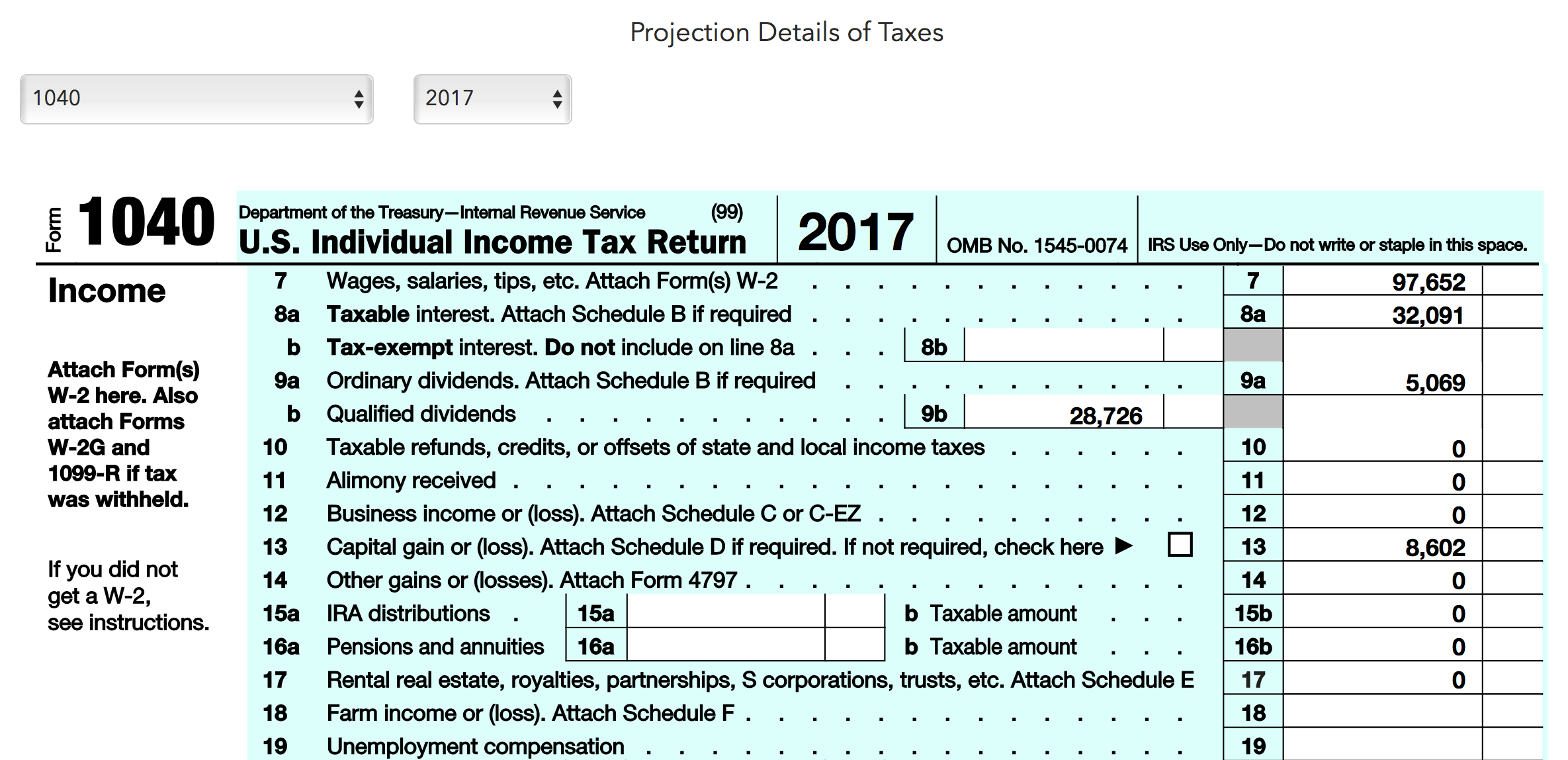

MVM can help highlight tax liability with detailed tax estimate

Detailed 1040 projection including Schedules A, B, and D

Show AMT calculation, taxable social security, rental property, and more

MVM does not provide tax, accounting or legal advice

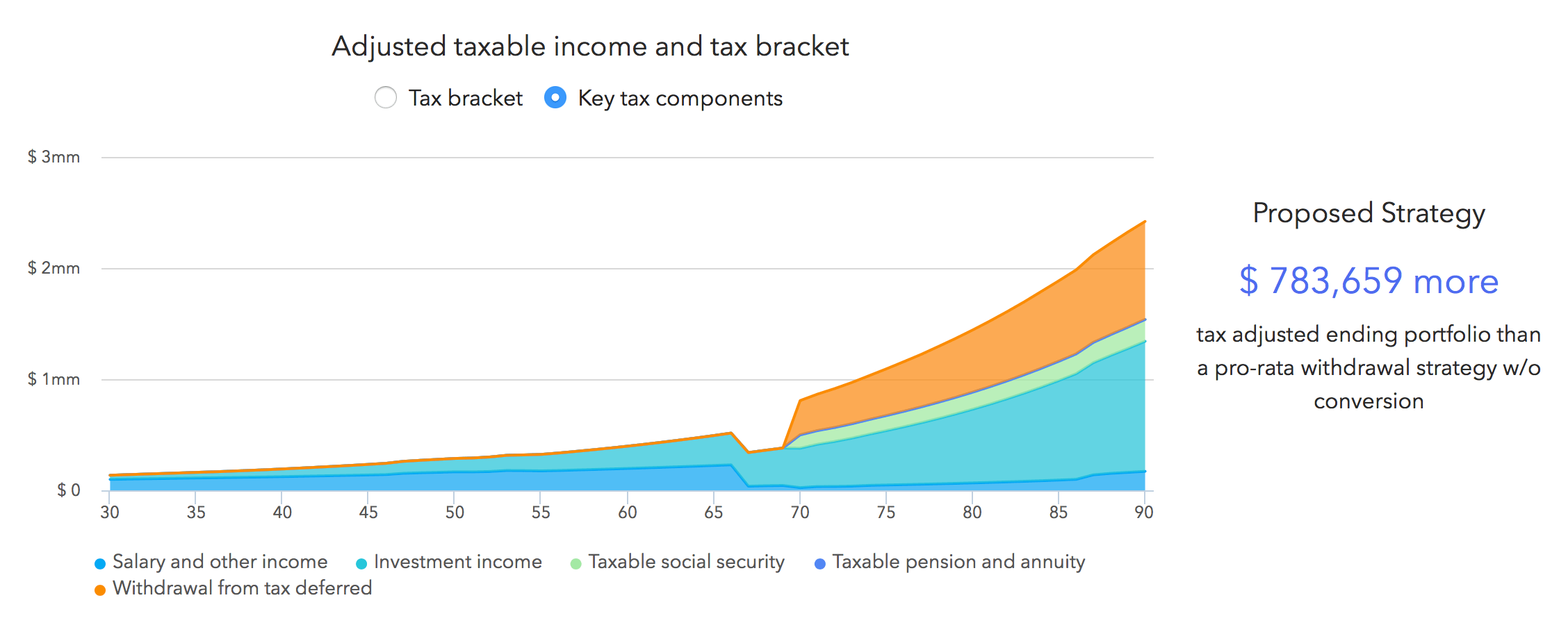

MVM will work with you to help find the most tax-efficient drawdown strategy and Roth conversion

Compare different drawdown strategies

Use Roth conversions to fill up tax brackets

Factor in social security, pensions, annuities, and other income

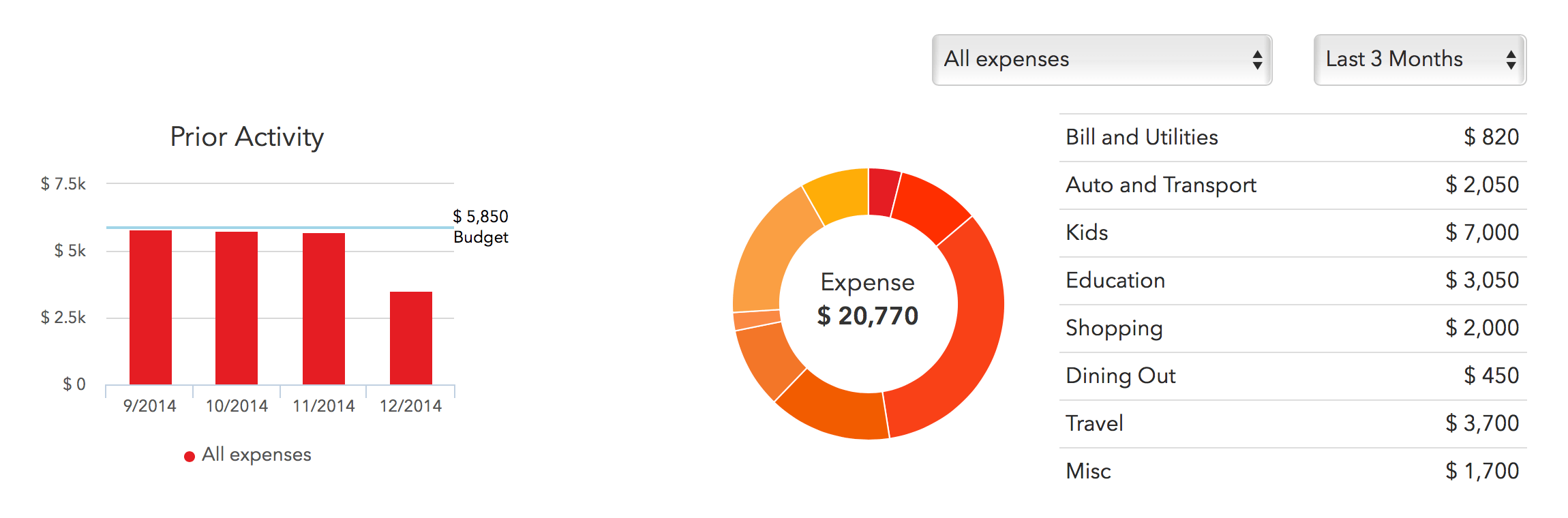

With our easy to use budgeting tool, keep track of all your accounts

Aggregate accounts from over 8,000 financial institutions

Automated expense categorization

Create and monitor cash flows with ease

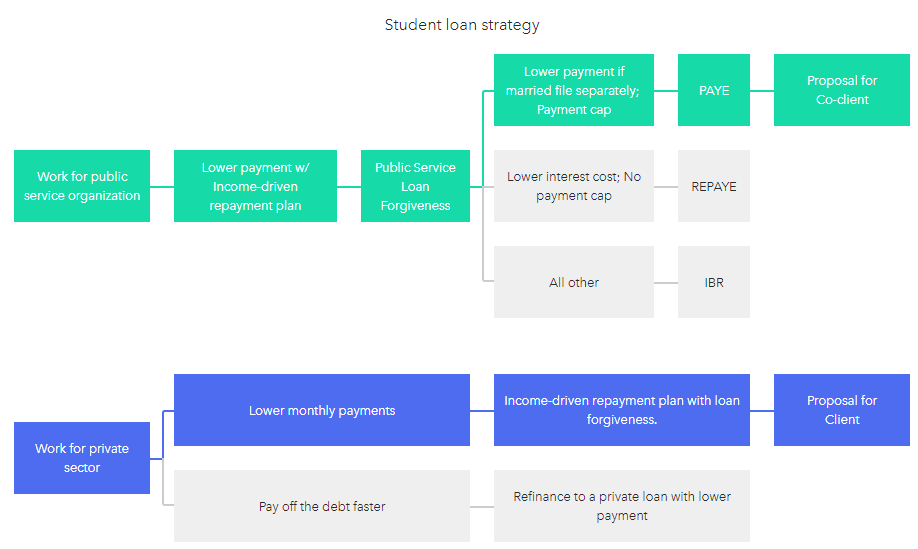

MVM will work with you to see the best way to handle your Student Loan debt

For clients with Student Loan debt, our Student Loan module illustrates those loans and possible strategies for dealing with those loans. This includes income-driven repayment plans, Public Service Loan Forgiveness (PSLF), consolidation, refinancing, and more.

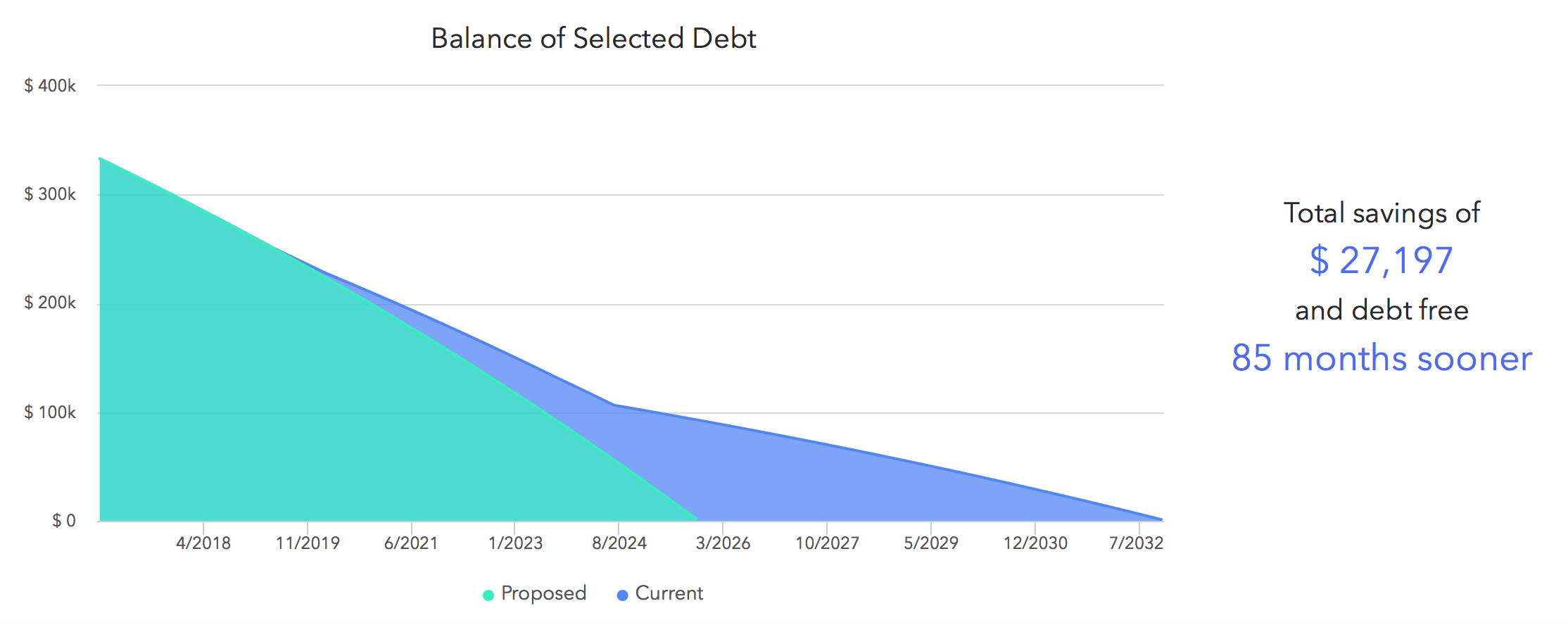

MVM can help show you the best strategy to get your debts pay off sooner

Compare different payoff plans

Dial the debt payment up and down

Quantify the impact of different debt pay-off strategies

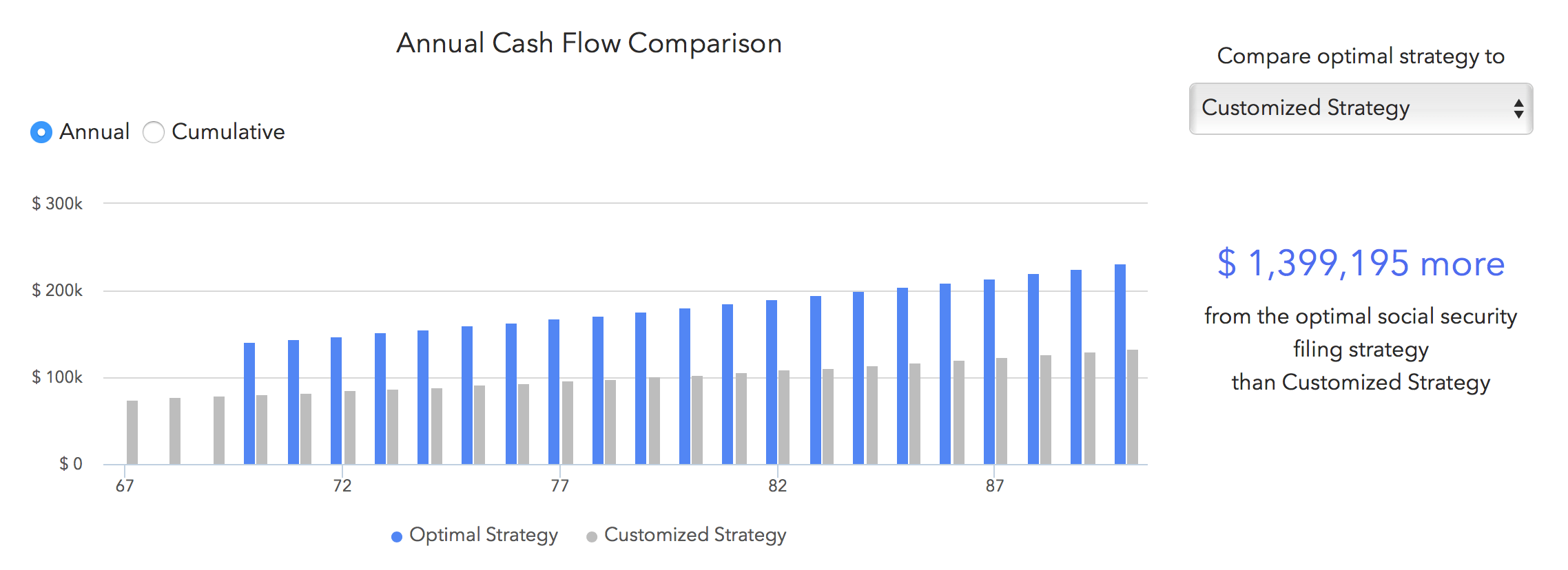

Optimize Social Security

Calculate the PIA including delay credits, early penalties, and inflation adjustment

Include retirement, spousal, survivor, and child benefits

Reflect the annual earnings test, family max adjustment, and government pension offsets

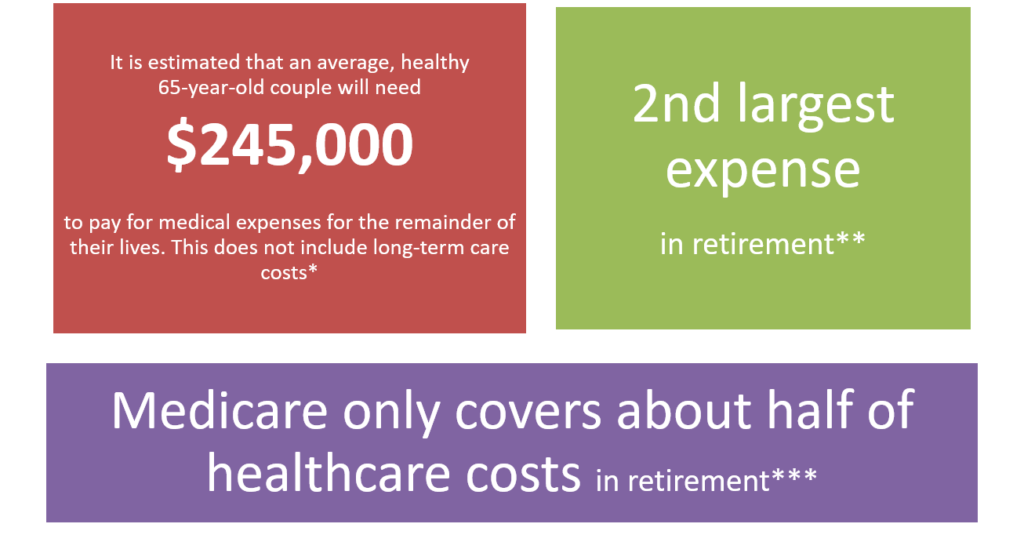

Planning healthcare costs in retirement

*Fidelity Investments retiree health costs estimate, 2015. Healthcare and nursing home costs may vary by state.

** Take Control of Your 6 Biggest Retirement Expenses,” U.S. News & World Report, August 2015

*** U.S. News & World Report, Take control of your 6 biggest retirement expenses, August 2016

Work with annuities with guarantees

Illustrate fixed, indexed, and variable annuities

Reflect annuitization or lifetime income benefits