Investing for Individuals and Families

Our personal service begins with an analysis of where you are today and we then project that into the future to see where you are in relationship to your goals.

We can help you answer many of the questions you may have.

- Do I have enough to retire when I want to?

- Am I saving enough for retirement?

- How much will it cost to educate my children?

- Am I saving enough to cover education costs?

- Is my asset allocation the right one for me now?

- Do I have an estate plan in place to provide for my family after I'm gone?

Investing today for tomorrow, the MVM Way!

In today's world, managing your financial affairs has never been more challenging. The once simple tasks of managing income, expenses, and investments has been made more difficult by inflation, depreciation, taxes and the daunting array of investment vehicles and services that are available.

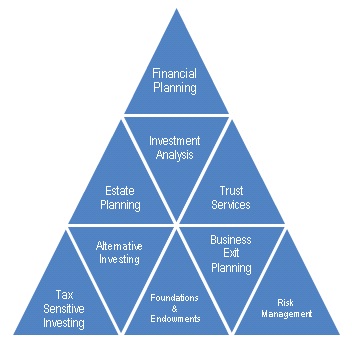

MVM's advisory services focus solely on your specific needs to design a customized long-term plan. Through the MVM planning process, your MVM Financial Advisor will work with you, offering personalized guidance and value-added information.

Through the MVM planning process you will define where you are today, and where you are with regard to your future goals and objectives. Through planning, you can work towards the financial future you desire with the right strategies in place to get you there.

Our ongoing goal, portfolio and investment policy statement reviews will help you stay on the right track. By analyzing your goals, time horizon and tolerance for investment risk on a continual basis, your MVM Financial Advisor will help you update your plan as your circumstances and needs change.

Through our advisory services, we strive to identify where you are in relationship to your financial goals, and highlight those issues that may represent a potential obstacle to reaching your goals.

Your MVM financial advisor can work with you, your attorney, and tax professionals to help ensure all your needs are met and properly executed. MVM does not offer legal or tax advice.

We diversify your portfolio across many different investments and asset classes and pay close attention to fees and expenses with the goal of providing a high-quality portfolio at the lowest possible cost. These skills, together with our experience working with institutional investors and our ability to integrate best in-class tax optimization strategies, mean that we are ideally qualified to work with you to understand and fulfil your investment needs.

- We seek to understand the needs of our clients and build applicable solutions

- We are committed to continuous dialogue and providing access to MVM's extensive resources

- We are highly experienced in customized reporting that today's complex investment portfolios demand

- Working with our custodians we offer many other value-add beyond portfolio management

- Our investment horizon is aligned to that of our clients — we are in it for the long term

MVM has learned that innovative thinking, active investing, and managing risk can produce superior client outcomes. We take an institutional approach to investment management and follow a disciplined due diligence process when selecting investments for your portfolio.

MVM offers traditional and alternative investments within multiple product structures, including segregated accounts, separately managed account, mutual funds and Exchange-Traded Funds (ETFs).